The Complete Solution for Your Parts Business

Everything you need to setup, optimize, and accelerate your parts business.

Online Sales of Genuine OEM Parts and Accessories Have Skyrocketed

Buyers need to find you—it’s time to get online using RevolutionParts!

WEB STORE

Fuel your parts business by providing your customers with an impressive and simple shopping experience. With a modern parts webstore, we supply you with all the tools you need to turbocharge your parts department revenue.

DEALER SITE PLUGIN

The parts form on your website might not be working for you, but we’ve got something that will. Our Dealer Site Plugin lives directly on your dealer site and provides your customers with a self-service parts buying experience.

EBAY

eBay Motors attract millions of customers looking for genuine OEM parts and accessories. Waived listing fees, a top store tier, and bulk inventory uploading are just a few of the benefits that come with using RevolutionParts to sell on these marketplaces.

Grow Your Wholesale Business

Selling to repair shops has never been easier.

Transform the way you receive, process, and deliver part orders from your local wholesale customers. With our all-inclusive solution, you’ll attract new wholesale buyers and increase orders from existing partners.

Sell More Accessories

Auto accessory sales make up a $45 billion-a-year business in the US. With RevolutionParts you can quickly and easily tap into this revenue hub, making your parts available wherever customers are shopping.

Quickly Move Aging & Obsolete Parts

Aged parts burning a hole in your wallet? Leverage the power of eBay Motors and RevolutionParts to get them sold. With us, you’ll get:

Free eBay Anchor Store Tier

Waived Listing Fees

Our All-In-One Managing Dashboard

Bulk Inventory Upload Tools

Much more…

Last year, dealerships selling on eBay with RevolutionParts sold: $27,538,208

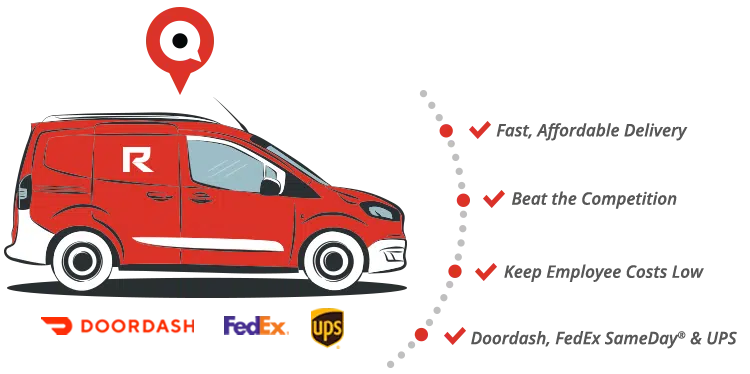

Same-Day Delivery:

A Premier Hotshot Service

Improve the way you service your local parts customers. Our latest feature supplies you and your customers with the option to pick up and deliver any local part order in an hour and at the fraction of the cost!

Proudly Accelerating Part

Sales For These Brands

What Our Customers Are Saying About Us

Curry Acura

Mazda New York

Michael Renaud, Vice President of Leader in Cars Auto Group, grows Mazda NY part sales with eCommerce.

Patrick Motors

Matt Patrick of Patrick Motors builds online part sales revenue to $151K a month using RevolutionParts.

Gateway Buick GMC

Craig Shield, Parts Manager of Gateway Buick GMC started selling online after an unlikely stock order mistake.

Honda Superstore Of Lisle

As eCommerce has become more competitive, people like Katherine Akre will be the ones who stand on top of the parts-selling world.

Crest Volvo

Nick Mendoza Of Crest Volvo Saves $4k/month By Using Local Delivery

All Star Dodge Chrysler Jeep Ram

All Star DCJR Leads the Way in Customer Service ExcellenceMeet Justin Akin and the All Star DCJR crew. This isn't just any parts...

Cat Security

Cat Security Reaches Over $3 Million in Annual Sales with RevolutionParts When Cat Security's team saw an urgent problem among...

Mercedes-Benz of Laredo

Mercedes-Benz of Laredo Grows Their Sales by 200% In One YearIn the 18 years that Mike Adams has been a parts manager, he knew...

All Star DCJR

All Star DCJR Builds a Multi-Million Dollar Parts Business Justin Akin, owner of All Star Dodge Chrysler Jeep Ram and winner of...

Findlay Chevrolet Las Vegas

Findlay Chevrolet of Las Vegas Takes Full Advantage of eBay to Push Monthly Online Parts Sales Over Six Figures Allen Salanio...

River City Ford

Kelly Marsden at River City Ford is Dominating Sales Across CanadaKelly Marsden has 15 years of experience in the auto industry...

Mike Hale Acura

Paul Goold of Mike Hale Acura Drives Success Within the First Year of Selling With RevolutionPartsPaul Goold has been the parts...

Carlock Toyota of Tupelo

The Team at Carlock Toyota Share How They’ve Created a Thriving Online Parts Business Will Robinson and Chris McMillen from...

Honda of Jonesboro

Jessica Rosales of Honda of Jonesboro Drives Success Through Strategic Ad SpendingJessica Rosales, the Parts Manager at Honda of...

Clark Knapp Honda

Cesar Aranda of Clark Knapp Honda is building a successful international parts business by selling and marketing with...

Featured Content

2023 Parts eCommerce Year in Review

Top 6 Benefits of Adding eCommerce to Your Parts Department